|

| (圖片來源:Concord at Williamcrest, retrieved on 26 Dec 2018) |

|

| (圖片來源:America First Multifamily Investores. L.P., retrieved on 26 Dec 2018) |

|

| (圖片來源:Morningstar:ATAX, retrieved on 8 Jan 2019) |

|

| (圖片來源:2018 Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities, retrieved on 27 Dec 2018) |

|

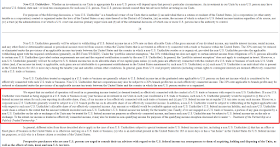

| (圖片來源:2018 Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities, retrieved on 27 Dec 2018) |

|

| (圖片來源:America First Multifamily Investors, L.P. Prospectus Supplement (To Prospectus dated November 29, 2016), retrieved on 27 Dec 2018) |

|

| (圖片來源:Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, retrieved on 27 Dec 2018) |

至於是否要填 Form W-8ECI 呢,答案是否定的:

不過,由於 ATAX 業務對魔術師一類的 foreign partner 來說算是 Effectively Connected,所以就要好似美帝公民咁交 capital gain tax 了。但美帝的資產增值稅稅率非常複雜,加埋魔術師係 PTP 的 foreign partner 身份,就更加複雜。簡單而言,capital gain 的稅率要視乎是 short term capital gain(37%)、long term capital gain(最高 20%)、collectibles(28%)、unrecaptured Section 1250 gain(25%) 等等而定(上述稅率係2018年資料),都係等下年(2020)收到2019年份 Schedule K-1(Form 1065)再講。

|

| (圖片來源:Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., retrieved on 29 Dec 2018) |

|

| (圖片來源:2018 Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities, retrieved on 27 Dec 2018) |

(註2:本文為魔術師自己對美帝稅法的自行理解及分享,並不構成任何投資及/或稅務建議。讀者如有疑問,請自行請教相關投資顧問及稅務顧問為宜。)

***

伸延閱讀:

Wikipedia:Capital gains tax in the United States

What Is a Mortgage Revenue Bond?

我買過一隻SXCP, 都是partnership, 報稅時IB另外有信寄來家中, 因買的數量很少,故去年沒有理會。

回覆刪除係呀, 如果少數就唔值得理會了.

刪除