2017年12月18日(星期一)先收到結單,才可以有 reference number 跟大貓理論。放咗工夜晚黑寫 email,大貓收到已是12月19日(星期二)了。

Hi HSBC,網上理財網頁話三日內回覆,於是魔術師等了三天,見大貓無回應,便在12月22日(星期五)打去熱線同佢做冬,終於有個「高級

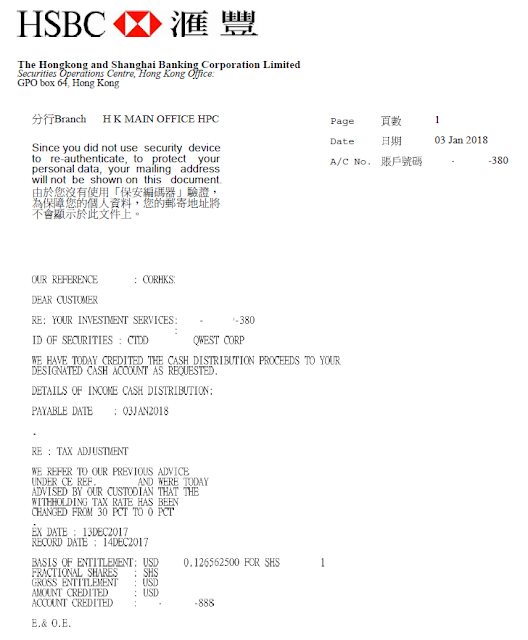

Regarding the interest payment of QWEST 6 75 NTS (CTDD : NYSE) (Ref: CORHKSXXXXXX), HSBC has charged me the 30% withholding tax.

However with reference to the prospectus, the 30% withholding tax should not be applicable to non-U.S. holder :

https://www.sec.gov/Archives/edgar/data/68622/000119312517128424/d371462d424b5.htm

QUOTE

Non-U.S. Holders

Payments of Interest on the Notes. Under the “portfolio interest” exemption and subject to the discussion below concerning FATCA withholding, the 30% U.S. federal withholding tax that is generally imposed on interest from United States sources should not apply to any payment of principal or interest (including original issue discount) on the Notes

UNQUOTE

In this connection, could you please look into this subject matter and, if appropriate, refund the wrongly charged the 30% withholding tax (USDXXX) to my USD saving account XXX-XXXXXX-888?

For further query, please feel free to contact me at 9XXX-XXX or email xxx@xxx

Thanks and regards,

跟住係聖誕假和新年假,放假氣氛濃厚,就連魔術師自己都休多兩天,故此亦不便追問。到得2018年1月2日(星期二),明知大貓我城日間辦公時間只會收到12月29日美帝大貓的回覆,睇死班美帝 hea 精唔會點做嘢,所以留返1月4日先打去問。結果又係同一樣,「後勤部門同事跟進緊」。

點知話口都未完,「高級

算喇,唔咬文嚼字嘞,總之收到錢就得喇!

多謝分享。金融機構對這些股息債息扣稅的分類其實好X亂,確實要自己小心看好。

回覆刪除我覺得美股市場其實唔係太 organised,乜款式的 product 都有得 trade。

刪除自己身家梗係要睇到實喇!

Thank you. Very educational sharing!

回覆刪除不用客氣!

刪除多謝分享。成功同Hong Kong Bank拎翻withholding tax無被人帶你遊電話河。真厲害

回覆刪除一切要由一篇成功的 email 開始。

刪除