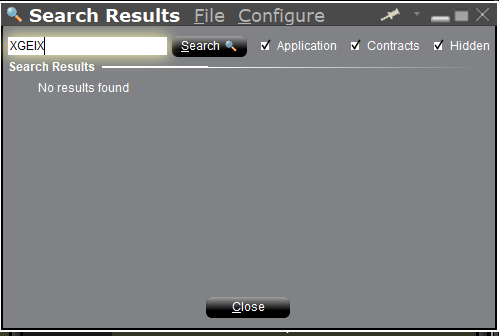

魔術師首先着眼的就是「幫襯開」的基金公司,例如 Guggenheim 就有呢隻 Guggenheim Energy & Income Fund (XGEIX)

|

| (圖片來源:Guggenheim Home > CEF > GUGGENHEIM ENERGY & INCOME FUND, retrieved on 3 Jun 2018) |

|

| (圖片來源:Guggenheim Home > CEF > GUGGENHEIM ENERGY & INCOME FUND > DISTRIBUTIONS & TAX INFO, retrieved on 3 Jun 2018) |

|

| (圖片來源:Barchart.com > XGEIX, retrieved on 3 Jun 2018) |

無錯魔術師是開心得太早了,原因是:

全能的 Interactive Brokers 竟然無得買呢個 product?魔術師再運用 attention to details, 睇真啲,原來 XGEIX 係無上市嘅!

|

| (圖片來源: Guggenheim Home > CEF > PRODUCTS, retrieved on 3 Jun 2018) |

Non-Listed Closed-End Fund Risk車,其實老散控利呢類風險可以好簡單:咪就係控利注碼,唔好訓身咪得囉!

The Fund is designed for long-term investors who are prepared to hold the Common Shares of the Fund until the end of the Fund’s term and not as a trading vehicle. An investment in the Common Shares, unlike an investment in a traditional listed closed-end fund, should be considered illiquid. The Common Shares are appropriate only for investors who are seeking an investment in less liquid portfolio investments within an illiquid fund. An investment in Common Shares is not suitable for investors who need access to the money they invest. Unlike shares of open-end funds (commonly known as mutual funds), which generally are redeemable on a daily basis, the Common Shares will not be redeemable at an investor’s option. Unlike traditional listed closed-end funds, the Fund does not intend to list the Common Shares for trading on any securities exchange, and the Fund does not expect any secondary market to develop for the Common Shares in the foreseeable future. The net asset value of the Common Shares may be volatile and the Fund’s use of leverage will increase this volatility. As the Common Shares are not traded, investors may not be able to dispose of their investment in the Fund no matter how poorly the Fund performs.

Shareholder Liquidity Event Risk

The Fund intends to complete a Shareholder Liquidity Event on or before the Liquidity Event Date, July 28, 2023. If the Board of Trustees determines that under then current market conditions it is in the best interests of the Fund to do so, the Fund may extend the Liquidity Event Date for one year, to July 28, 2024, without a shareholder vote. The Fund’s investment objectives and policies are not designed to seek to return to investors that purchase Common Shares in this offering their initial investment on the Liquidity Event Date or any other date.

Tender Offer Risk

Beginning 18 months after the completion of the offering, the Fund intends, but is not obligated, to conduct quarterly tender offers for up to 2.5% of the Common Shares then outstanding in the sole discretion of the Board of Trustees. In a tender offer, the Fund will offer to repurchase Common Shares at the Fund’s net asset value per Common Share or a percentage of the Fund’s net asset value per Common Share on the last day of the offer. In any given quarter, the Fund may choose not to conduct a tender offer or may choose to conduct a tender offer for less than 2.5% of the Common Shares then outstanding. Accordingly, there may be periods during which no tender offer is made, and it is possible that no tender offers will be conducted during the term of the Fund. If a tender offer is not made, Common Shareholders may not be able to sell their Common Shares as it is unlikely that a secondary market for the Common Shares will develop or, if a secondary market does develop, Common Shareholders may be able to sell their Common Shares only at substantial discounts from net asset value. If the Fund does conduct tender offers, it may be required to sell its more liquid, higher quality portfolio securities to purchase Common Shares that are tendered, which may increase risks for remaining Common Shareholders and increase fund expenses as a percentage of net assets....

又,在 Guggenheim 網站研究資料期間,發現其網站有過輕微改版(職業病發作),其中 ETF 產品不見了!魔術師唯有問問 Google 大神,終於找到答案:原來 Guggenheim 的 ETF 業務俾 Invesco 收購咗!

|

| (圖片來源: Invesco expands its ability to meet client needs by completing its acquisition of Guggenheim Investments' ETF business, retrieved on 3 Jun 2018) |

希望Guggenhei被收購之後唔好影響GOF,否則又係另一打擊

回覆刪除Guggenheim 被 Invesco 收購的是 ETF 業務, 而 GOF 是 CEF, 依然在 Guggenheim 產品名單之內.

刪除哦,我無睇清楚,咁都安心少少

刪除attention to details... XD

刪除I suggest you can take a look of dkt which is currently trading at 25.6 and ex dividend on end of this month. It is also becoming callable at that same time. At least you won’t pay much premium over if it is actually getting called. And the trade volume is great no worry not able to sale if needed.

回覆刪除PATRICK

以前我買過DTK, 不過止蝕離場, 依家仲 call 埋添, 所以我覺得DKT 的被 call 的風險也不小, 所以暫不考慮.

刪除HSEA同HSEB係無可代替的,魔兄再揾到相近的記得分享下,造福人群啦。

回覆刪除哈哈, 咁就要留意本月的資產配罝文章喇!

刪除