到得見到魔術師「上當」,順利打開話匣子,那時這些「理財顧問」便會話鋒一轉,講話魔術師的理念係幾咁有問題,然後就拋一輪書包,旁徵博引,引述一些名家大師之言,還魔術師覺得自己原來都很「渺小」。

對「理財顧問」來說,最理想的便是魔術師驚覺自己原來一直都自以為是,在自謙為「很無知」的「理財顧問」面前,無知又自大的其實是魔術師自己。

就在魔術師氣餒沮喪,頓覺自己只是「庸才」一名的時候,自不然會對比「無知的魔術師」略懂多一點點的「理財顧問」言聽計從(魔術師要去問真高手嗎?人家才不理你呢!都係只係搵個比自己叻少少的「理財顧問」俾意見好啲!)。

當然,世間事不會太理想。

魔術師沒有受過類似的銷售訓練,不知道這些捉緊客戶心理的 script 有沒有什麼名堂;不過魔術師只知道,十個有十個「理財顧問」,去到拋書包的 step,就已被魔術師「打」到落荒而逃。

又咁講,職業無分貴賤,做 sales 推銷產品本來是正當行業,魔術師對其本質上並無惡感;sales 形象低,主要係來自邪門的銷售手法:你唔係去聆聽並明白顧客所需,再做 consultancy 或 advisory,而係去 manipulate 客人的心理或需要,催眠客人製造需求,令客人當刻覺得有需要去買某些產品,但冷靜下來客人卻發現不是那麼的一回事,最後投訴無門,所以才有「sales 呃人」之說。

我城開班財演多如恆河沙數,打開 Facebook 實會見到有關的面書廣告,但其中最出名的開班又非最鍾意要其學員自認「庸才」的,就非乜sir莫屬。

這天閒來無事,走去睇下乜sir那些疑幻似真的讀者/學生來信,竟然見到乜sir話「有同學問債基派出的息是否由基金本金中提取?」乜sir作為城中著名的良心導師,當然需要澄清:

|

| (圖片來源:債基收息的風險與回報10年期剖析 #1446, retrieved on 29 Oct 2017) |

又會咁啱嘅,魔術師想起日前《債基月息從本派?》,馬上便要對號入座,原來該文有4千幾 hits (截至2017年10月29日),睇嚟真係唔少人關心債基派息問題,搞到一個月內可以累積到呢個瀏覽率,對魔術師來說已經算係非常唔錯的成績。究竟呢4千幾 hits 之內,會唔會有乜sir的學員在內呢?

其實要 search 乜sir個推介其唔難,都唔知佢左遮右遮做乜。唔通佢班學員都係飯來張口,衣來伸手的伸手黨?

|

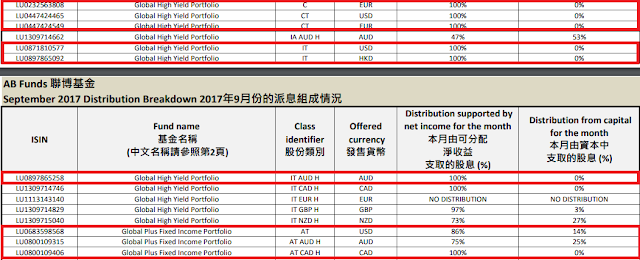

| (圖片來源:聯博基金的派息組成情況,retrieved on 29 Oct 2017) |

|

| (圖片來源:聯博-環球高收益基金(AT HKD),retrieved on 29 Oct 2017) |

|

| (圖片來源:聯博-環球優越收益基金(AT AUD H),retrieved on 29 Oct 2017) |

再睇返聯博基金的派息組成文件對「可分配淨收入」的定義,可謂跟安聯基金的定義類似(見《債基月息從本派?》):

從 2013 年 10 月 29 日起,本文件內的可分配淨收入之計算方法已變更。以新方法計算的可分配淨收入是指本月份就有關股份類別的淨投資收入或包括本財政年度內以往月份比較聯博-環球高收益基金(AT HKD)(下稱「聯博」)及早前在《債基月息從本派?》中提及的安聯動力亞洲高收益債券基金 (美元) AMg 每月派息(下稱「安聯」),睇勻全年,以每月派息論,聯博雖然都有從資本派息,但派出的百份比較安聯少;不過安聯就善用從資本派息來「維穩」,致令每月派息保持不變,令投資者容易計數,不似聯博咁實牙實齒地減派息。派息政策可謂各有優點。

(如適用) 之盈餘 (即股息加上利息收入減去費用及開支)。可分配淨收入並不包括淨實現收益 (如有)。

不過睇返兩年圖,以回報來說,安聯就似乎稍勝一籌了:

|

| (圖片來源:Fundsupermarket.com > 圖表中心, retrieved on 29 Oct 2017) |

伸延閱讀:

Fundsupermart.com:高現金派息類別——債券基金(2017年10月)

天路客:我在IB第一次買債券的流程(yogie4/12/2017 2:40 下午)

債基月息從本派?

電車男的職業病

A lot of times, people don’t know what they want until you show it to them.

回覆刪除https://www.forbes.com/sites/chunkamui/2011/10/17/five-dangerous-lessons-to-learn-from-steve-jobs/amp/

不能否認,這很符合人性,並且成為近年銷售技巧的ABC。

c&p漏咗。全文如下

刪除//你唔係去聆聽並明白顧客所需,再做 consultancy 或 advisor,而係去 manipulate 客人的心理或需要,催眠客人製造需求,令客人當刻覺得有需要去買某些產品,但冷靜下來客人卻發現不是那麼的一回事

喂,阿真正既教主Steve都係咁講架:

A lot of times, people don’t know what they want until you show it to them.

https://www.forbes.com/sites/chunkamui/2011/10/17/five-dangerous-lessons-to-learn-from-steve-jobs/amp/

不能否認,這很符合人性,並且成為近年銷售技巧的ABC。

//A lot of times, people don’t know what they want until you show it to them.

刪除Help customers visualise their needs and wants 係正常嘅,但 create illusion 話俾客人知佢地有某種「需要」,由儲蓄保險回報到有青一畢業就要買樓搬出嚟住要有私淫空間,卻是誤導性的。呃得一次,呃唔到第二次(有青除外)。

嘩, 魔術師兄你拆人台喎...人地報左幾千銀班的資料你公開左, 學員會唔會好揼春架?

回覆刪除一拆二按爆8成做埋老湯, 銀行一驗樓CALL LOAN就.......

或者按爆8成收息, 槓桿再槓桿, 到時就一桿清枱了

//人地報左幾千銀班的資料你公開左, 學員會唔會好揼春架?

刪除作死咩!乜sir左遮右遮,又搵人edit個PDF (跟原裝版少了幾隻基金),結果我一分鐘都唔使就search 到。我就唔信乜sir上堂就係講埋啲咁表面嘅嘢嘞!

//老湯, 銀行一驗樓

「最多咪釘契,租照收!」

//槓桿再槓桿, 到時就一桿清枱了

「你識唔識 standard deviation 架?」

//「你識唔識 standard deviation 架?」//

刪除你識唔識 "probability"、"normal distribution"架?你識就唔會咁問

Fooled by Randomness - Nassim Taleb [Animated]

https://www.youtube.com/watch?v=Rwy0LNAbPHs

Nassim Nicholas Taleb: Problems with probability

https://www.youtube.com/watch?v=_Sy7NPVFx7k

馴獸師

//你識就唔會咁問

刪除鬥獸棋, 高你一個級別就足夠食你了.

食我?你哽得落 NN Taleb 的料至講.

刪除See "The Black Swan / The Impact of the Highly Improbable" ( Chapter 15: The Bell Curve, That Great Intellectual Fraud, P.229 ~ 252)

"Love of Certainties: If you ever took a (dull) statistics class in college, did not understand much of the professor was excited about, and wondered what 'standard deviation' meant, there is nothing to worry about...Standard deviations do not exist outside the Gaussian, or if they do exist they do not matter and do not explain much. But it gets worse. The Gaussian family (which includes various friends and relatives, such as the Poisson law)are the only class of distributions that the standard deviation (and the average) is sufficient to describe. The bell curve satisfies the reductionism of the deluded.

There are other notions that have little or no significance outside of the Gaussian: correlation and, worse, regression...you cannot use one single measure for randomness called standard deviation (and call it "risk"); you cannot expect a simple answer to characterize uncertainty."

馴獸師

//你哽得落 NN Taleb 的料至講.

刪除我自己就未有興趣去食邊個邊個的料,而且投資又使唔使𠼰 NN 的料呢?

你睇坊間有不斷開班,桃李滿門的價值大師話「投資唔需要好似數學家咁,只需識加減乘除就夠」(大意);乜sir又開口埋口standard deviation:

http://homebloggerhk.com/83139/

740萬買樓後淨600萬,可將其中300萬分階段用收息101之債基疊增之法收租,收息為12-15%不等。300萬收息即每月30K-37.5K。可能你會諗收12-15%咁高息,有冇真係咁容易? 只好講11月上堂既同學最快可12月11日就有息落袋,課程已行47次。不少讀者由上海或新加坡轉程而至,對課程內容不敢掉以輕心。至於風險,由於最高息收25%的債基方案A都未出,所以行方案C-E收12-15%估計波幅為大部份學生所接受,即用標準差計出風險只為投資內股股收息的一半,在堂上亦由講解怎將風險量化開始。

作為港豬,點識咁多?梗係人講就信喇!

//而且投資又使唔使�� NN 的料呢?//

刪除投資冇方法,靠撞彩都得架。試問有幾多 "港豬" 會把成副身家用撞彩方式或用擲骰子來決定是否投資,來測試自己有幾好運?唔駛多講,係少之又少。

顯而易見,投資係要諗清楚同有方法喇!至於邊種方法是低風險和高回報,或高風險和低回報,或中風險和中回報等等,唔識分析又唔學,又怎會知有冇被人老點?連做左水魚都唔知?

講到尾,投資梗係要有正確方法喇,唔係㸃賺港豬的多餘錢!冇話一定要先學識 NN Taleb 的料先至可以投資,投資可大可小,想食大茶飯咁易咩!但如頭腦夠清醒和數口好,即係具備街頭智慧(street-smart)嗰種,細細地做日常買賣,山大斬埋有柴,都幾和味架!

Official Research Biography of Nassim Nicholas Taleb

http://www.fooledbyrandomness.com/CV.htm

"Summary: Taleb's works focuses on mathematical, philosophical, and practical problems with risk and probability, as well as on the properties of systems that can handle disorder. ***He spent 21 years as a derivatives trader*** and, after closing 650,000 option transactions and examining 200,000 risk reports, he changed careers in 2006 to become a scholar, mathematical researcher and philosophical essayist."

馴獸師

順便一提,Taleb 係打仔 (trader)出身,有廿幾年實際的 option trading 經驗,唔係坐係象牙塔教書,空有理論,成世人連一個trade都未做過嗰種口水佬。Taleb一早揾夠提早上岸,轉行做番佢有興趣的研究。

刪除Nassim Nicholas Taleb (Arabic: نسيم نقولا طالب, alternatively Nessim or Nissim, born 1960) is a Lebanese-American essayist, scholar, statistician, former trader, and risk analyst,[2] whose work focuses on problems of randomness, probability, and uncertainty. His 2007 book The Black Swan was described in a review by The Sunday Times as one of the twelve most influential books since World War II.[3]

Taleb is an author,[4] has been a professor at several universities, serving as Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008,[5] and as co-editor in chief of the academic journal, Risk and Decision Analysis since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, a derivatives trader and is currently listed as a scientific adviser at Universa Investments.

He criticized the risk management methods used by the finance industry and warned about financial crises, subsequently profiting from the late-2000s financial crisis.[6][7] He advocates what he calls a "black swan robust" society, meaning a society that can withstand difficult-to-predict events.[8] He proposes antifragility in systems, that is, an ability to benefit and grow from a certain class of random events, errors, and volatility[9] as well as "convex tinkering" as a method of scientific discovery, by which he means that decentralized experimentation outperforms directed research.[10]

[ Wikepedia, https://en.wikipedia.org/wiki/Nassim_Nicholas_Taleb ]

馴獸師

//試問有幾多 "港豬" 會把成副身家用撞彩方式或用擲骰子來決定是否投資,來測試自己有幾好運?唔駛多講,係少之又少。

刪除咁blog界都有運氣王嘅, C9王國都有人亂買架喇! 當然, 我等學命理的, 係知道有運氣回歸呢件事, 人生總係會有起趺.

//投資係要諗清楚同有方法喇!至於邊種方法是低風險和高回報,或高風險和低回報,或中風險和中回報等等,唔識分析又唔學,又怎會知有冇被人老點?

呢句我非常buy, 一來知道自己一向無運, 二來都叫做讀過下書, 好難說服到自己唔睇清楚諗清楚Plan好至買. 至於要學幾多? 個人意見係比「夠用」多兩三成就夠了, 太高深但又用唔着的知識只係nice to have.

//The bell curve satisfies the reductionism of the deluded.

Behavioral finance 好重要, 因為人性多數 avoid loss , 單就此一點已經令到市場唔會係 Gaussian 50/50 分佈.

//老湯, 銀行一驗樓

回覆刪除//「最多咪釘契,租照收!」

「我讀理科淨喺識數字同元素周期表唔識睇一堆文字嘅條例sorry!」

其實就連文科人唔會睇咁大堆文字!!

刪除